by Tomás Freyer | Jan 9, 2023

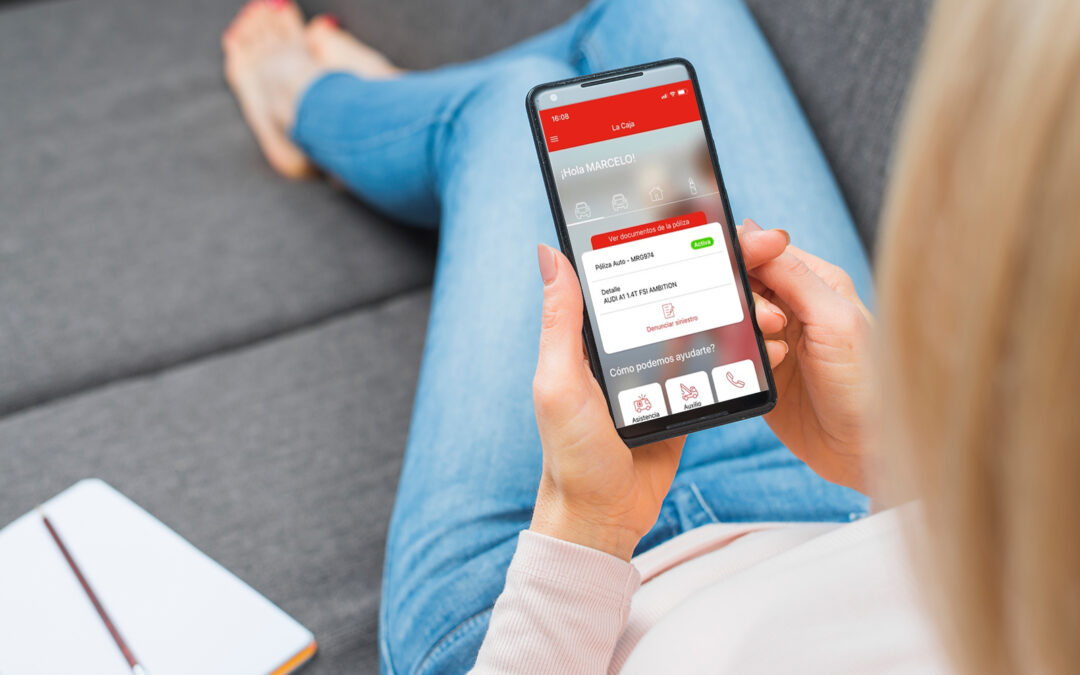

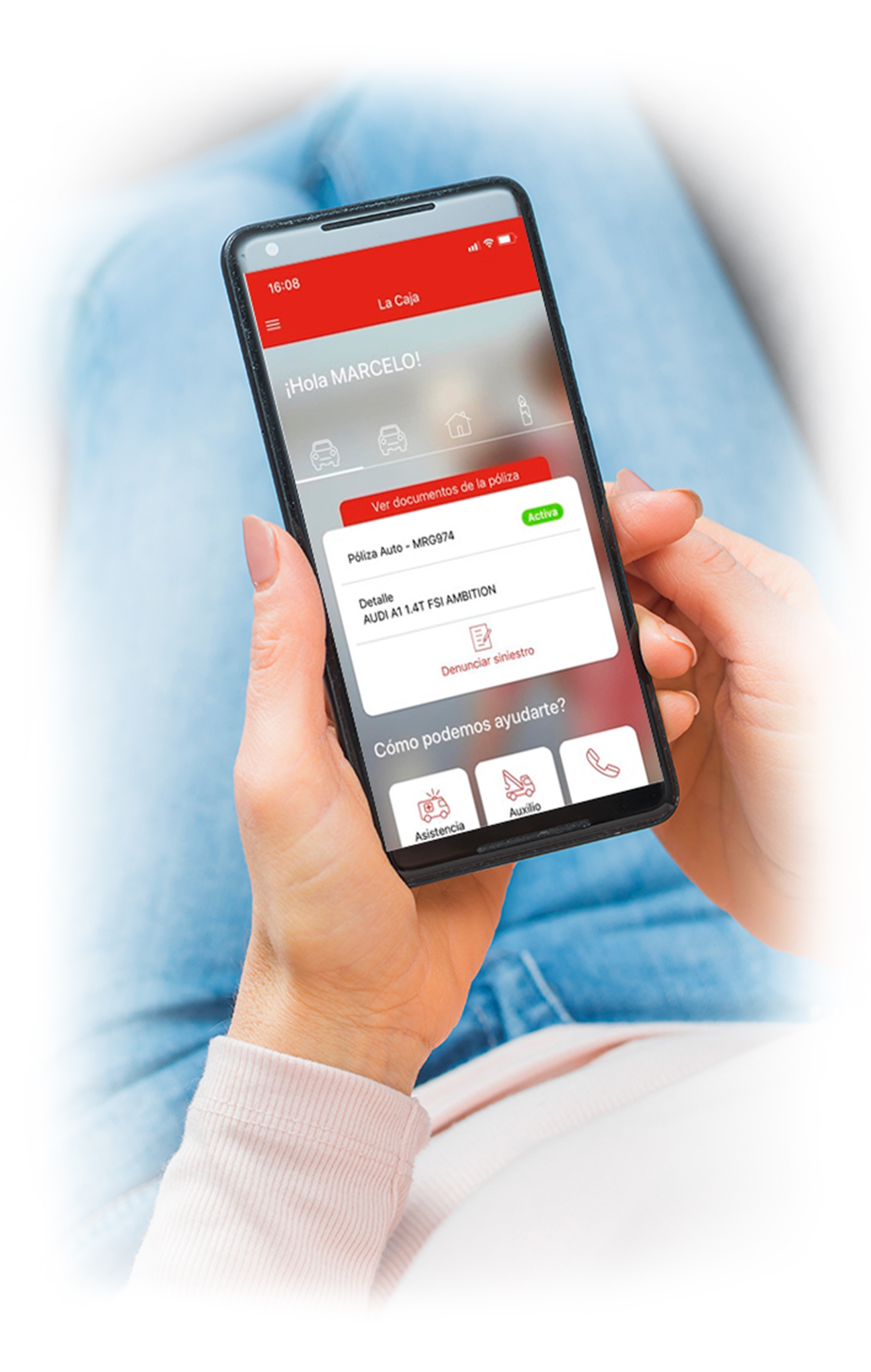

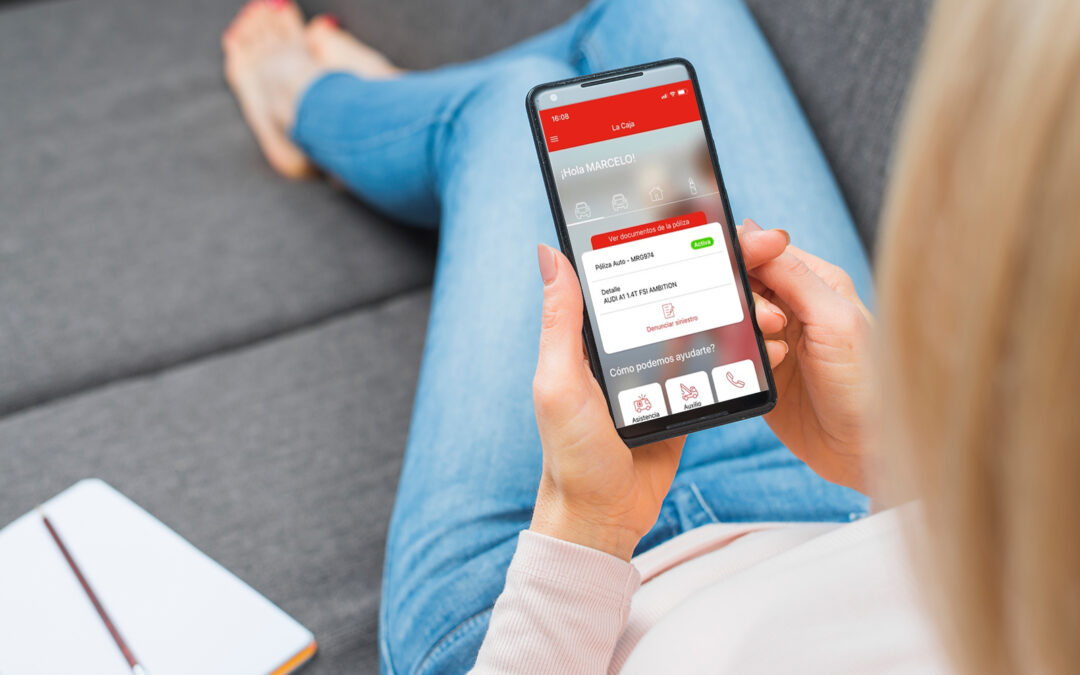

Development of the Mobile Hub application, which allows policyholders to carry out a series of procedures and transactions, without having to go to a commercial office.

Location: Argentina

Client: La Caja Seguros

Industry: Insurance

Service: Dedicated Teams

Expertise: Software Development

Technologies: Ionic4

Solution

The Mobile Hub app was developed from scratch to replace the existing app. From the new application, a policyholder can: consult his/her policies, get current circulation permits, report claims, check the status of procedures and reported claims, make payments and contact operators through chat.

For potential customers, it is possible to quote different insurance policies such as home and vehicle, check nearby branches, etc.

Background

Founded in April 1915, La Caja Seguros is one of the country’s main insurers, with a market share of around 6%.

Challenges

La Caja Seguros needed to catch up with the new habits of consumers, who prefer to carry out most of their transactions and requests for information through digital platforms, saving time by not having to go to a branch. At the same time, it needed to increase the accessibility of documents related to consumer insurance policies.

Business Objective

Increase consumer satisfaction levels by offering an application that allows them to complete all transactions and procedures related to their policies without having to go to a commercial office.

Results

Customers were able to access a completely new, easy-to-use and intuitive application with many more features available than the previous app.

The application was developed with its own framework using already developed components, allowing the addition of new functionalities with less effort and reusing components, also ensuring the homogeneity of the screens and ensuring the usability of the application.

Background

Founded in April 1915, La Caja Seguros is one of the country’s main insurers, with a market share of around 6%.

Challenges

La Caja Seguros needed to catch up with the new habits of consumers, who prefer to carry out most of their transactions and requests for information through digital platforms, saving time by not having to go to a branch. At the same time, it needed to increase the accessibility of documents related to consumer insurance policies.

Business Objective

Increase consumer satisfaction levels by offering an application that allows them to complete all transactions and procedures related to their policies without having to go to a commercial office.

Results

Customers were able to access a completely new, easy-to-use and intuitive application with many more features available than the previous app.

The application was developed with its own framework using already developed components, allowing the addition of new functionalities with less effort and reusing components, also ensuring the homogeneity of the screens and ensuring the usability of the application.

Would you like to join Huenei’s Tribe?

by Tomás Freyer | Jan 9, 2023

Formation of a specialist support and maintenance team for the construction, conditioning and commissioning of bank branches.

Location: Argentina

Client: Industrial Commercial Bank of China

Industry: Banks & Financial Services

Service: Dedicated Teams

Expertise: Software Development

Technologies: IT Continuity

Solution

A tailored team of up to 10 on-site experts, who had to have extensive knowledge in the installation and configuration of the bank’s entire technological infrastructure, as well as its platforms and applications, thus ensuring that these branches met all applicable quality standards.

Background

The Industrial Commercial Bank of China (ICBC) is one of the most profitable and stable financial institutions worldwide, with over 400,000 employees and a presence on all continents; it arrived in Argentina in 2011 with the purchase of Standard Bank.

Since then, it has managed to consolidate its presence within the country, becoming one of the 10 largest banks in Argentina, as a result of its constant expansion policy, which has led to a need for a technological partner capable of keeping up with its growth rate.

Challenges

Although Argentina has a significant preference for digital solutions, many users still have the habit of attending physical branches to carry out highly sensitive procedures, with bank branches being a central point in the institution’s policy for gaining presence in the country.

These branches had to meet all the necessary requirements at the technological and infrastructure levels for correct operation, as well as the parameters set out by the industry and the parent company.

Business Objectives

ICBC needed its branches to be operational in less than three months, this was order to meet the growing demand from customers, also seeking to improve the quality of service and personalized attention.

Due to this, he needed a flexible, autonomous and agile partner, who was able to take the entire process of setting up branches, from their planning to the opening of the branches.

Results

Thanks to the autonomy and agility of the team, we achieved compliance with all the goals set by ICBC, reaching the proposed deadlines, as well as the safety and quality parameters indicated by both the Argentine banking industry and the bank itself.

At the same time, the clients of this entity expressed an increase in satisfaction thanks to having a closer branch with shorter support times when carrying out procedures and requests that cannot be made online.

Background

The Industrial Commercial Bank of China (ICBC) is one of the most profitable and stable financial institutions worldwide, with over 400,000 employees and a presence on all continents; it arrived in Argentina in 2011 with the purchase of Standard Bank.

Since then, it has managed to consolidate its presence within the country, becoming one of the 10 largest banks in Argentina, as a result of its constant expansion policy, which has led to a need for a technological partner capable of keeping up with its growth rate.

Challenges

Although Argentina has a significant preference for digital solutions, many users still have the habit of attending physical branches to carry out highly sensitive procedures, with bank branches being a central point in the institution’s policy for gaining presence in the country.

These branches had to meet all the necessary requirements at the technological and infrastructure levels for correct operation, as well as the parameters set out by the industry and the parent company.

Business Objectives

ICBC needed its branches to be operational in less than three months, this was order to meet the growing demand from customers, also seeking to improve the quality of service and personalized attention.

Due to this, he needed a flexible, autonomous and agile partner, who was able to take the entire process of setting up branches, from their planning to the opening of the branches.

Results

Thanks to the autonomy and agility of the team, we achieved compliance with all the goals set by ICBC, reaching the proposed deadlines, as well as the safety and quality parameters indicated by both the Argentine banking industry and the bank itself.

At the same time, the clients of this entity expressed an increase in satisfaction thanks to having a closer branch with shorter support times when carrying out procedures and requests that cannot be made online.

Would you like to join Huenei’s Tribe?

by Tomás Freyer | Jan 9, 2023

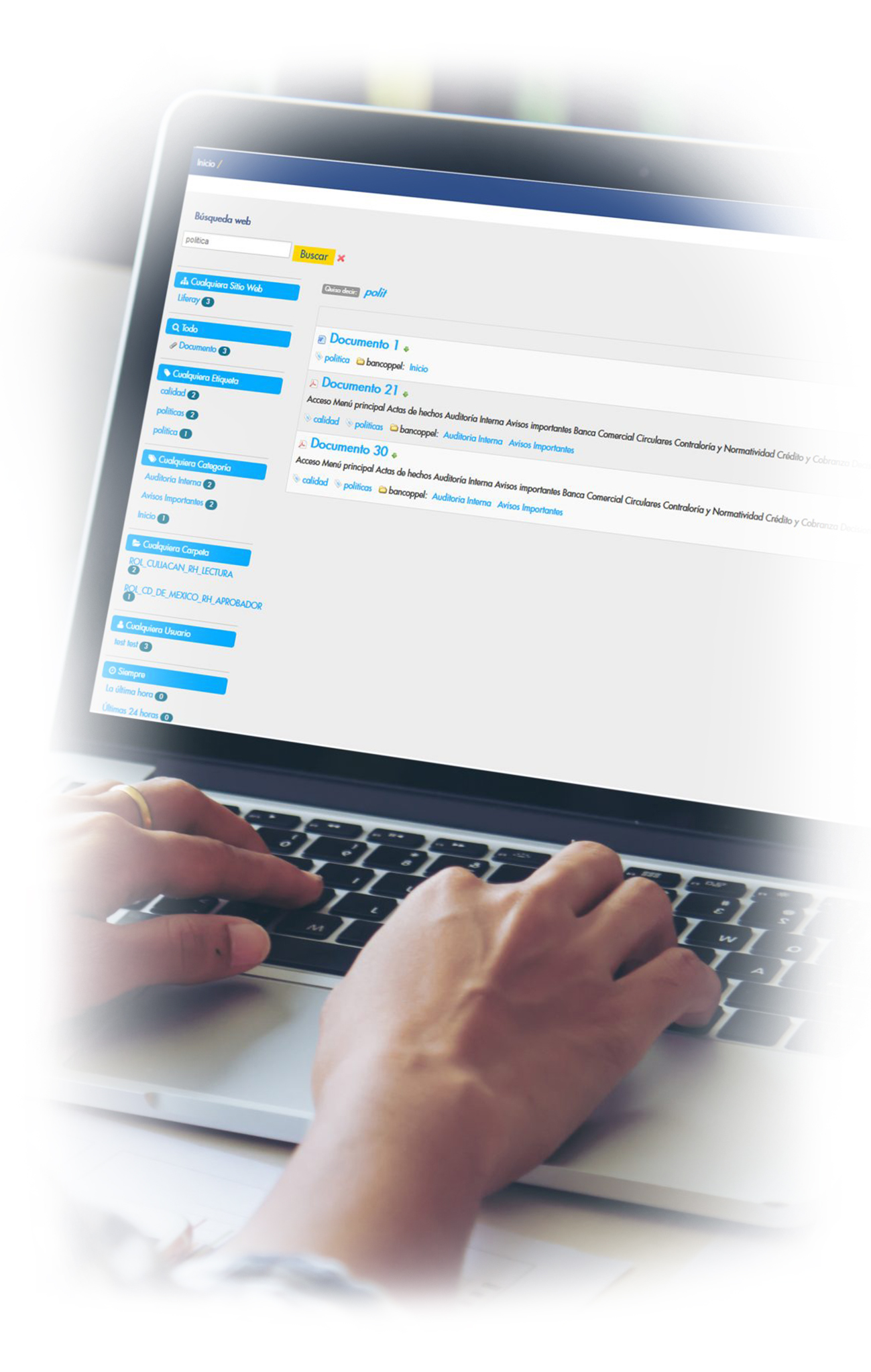

Development and customization of several functionalities to the company’s Intranet Portal, providing more efficient and secure tools to the organization.

Location: Argentina

Client: BanCoppel

Industry: Banca y Servicios Financieros

Service: Turnkey Projects

Expertise: Software Development

Technologies: Liferay

Solution

After conducting a survey of the company’s digital platforms, as well as validating the client’s general requirements, we decided to develop a portal in Liferay including a series of functionalities such as: viewing PDF documents, links to banking applications based to certain user profiles, the inclusion of biometric security (fingerprint) to access qualified information, preparation and configuration of workflows, advanced document searches, etc.

With these improvements, the company would be able to increase each worker’s hourly productivity, thus improving efficiency and overall production capacity, which would result in a better customer service.

Background

For over 50 years, Coppel has offered products and services to segments of the population with limited resources in order to improve their quality of life; The company is characterized by a corporate culture of awareness and social interest.

Among the companies that make up this corporation, we find BanCoppel, a financial institution with the same focus and target segments, managing to break through and consolidate itself in the Mexican market.

Challenges

BanCoppel’s efforts are focused on expanding the financial system to include a significant segment of the population currently outside the banking circuit; as this is a large sector, many efforts have been made to develop a powerful infrastructure and technological solutions capable of supporting this number of customers.

Among the benefits of having first-line solutions, the company can be more productive by having efficient tools and automated processes, thus improving customer experience and quality.

Business Objectives

BanCoppel has a significant number of tools for viewing and managing documentation throughout the organization and the 950 branches that comprise it, collecting information from employees and the bank.

The company needed to make a series of improvements to these tools and platforms, not only increasing security and reliability, but also reengineering processes to make general management faster.

Results

Once the new improvements and functionalities were included, the bank experienced an increase in its employees’ satisfaction, providing them with more management tools with greater efficiency and freedom, as well as a more accurate and streamlined process. On the other hand, the organization increased its production capacity, as well as its security standards, which improved its position in relation to its external client.

Background

For over 50 years, Coppel has offered products and services to segments of the population with limited resources in order to improve their quality of life; The company is characterized by a corporate culture of awareness and social interest.

Among the companies that make up this corporation, we find BanCoppel, a financial institution with the same focus and target segments, managing to break through and consolidate itself in the Mexican market.

Challenges

BanCoppel’s efforts are focused on expanding the financial system to include a significant segment of the population currently outside the banking circuit; as this is a large sector, many efforts have been made to develop a powerful infrastructure and technological solutions capable of supporting this number of customers.

Among the benefits of having first-line solutions, the company can be more productive by having efficient tools and automated processes, thus improving customer experience and quality.

Business Objectives

BanCoppel has a significant number of tools for viewing and managing documentation throughout the organization and the 950 branches that comprise it, collecting information from employees and the bank.

The company needed to make a series of improvements to these tools and platforms, not only increasing security and reliability, but also reengineering processes to make general management faster.

Results

Once the new improvements and functionalities were included, the bank experienced an increase in its employees’ satisfaction, providing them with more management tools with greater efficiency and freedom, as well as a more accurate and streamlined process. On the other hand, the organization increased its production capacity, as well as its security standards, which improved its position in relation to its external client.

Would you like to join Huenei’s Tribe?

by Tomás Freyer | Jan 9, 2023

Application Management Outsourcing.

Application management outsourcing (AMO) including support and maintenance of pharmacovigilance application levels 1, 2 and 3 for drugs in Argentina and Chile, through ITIL methodology, in accordance with good practices (GxP) required by Viatris.

Location: Argentina, Chile, United States Of America

Client: Viatris

Industry: Healthcare

Service: Dedicated Teams

Expertise: Software Development

Technologies: Microsoft .NET 2.0 con ASP .NET y VB .NET Azure

Solution

A series of customizations of the framework of the ITIL methodology were carried out to comply with a series of good practices of the company, for this it was necessary to form a technical team that had experience in said methodology, managing to implement the service model.

Additionally, an Azure-based high availability infrastructure was implemented for Argentina and Chile, all this carefully supervised by an external consultant, who ensured that the processes and quality standards of the Pharmacovigilance program were met.

To ensure completeness and correctness of the information, anomaly detection parameters were configured that will be notified after processing the files.

Background

Viatris needed to put in place a pharmacovigilance program for a product that required this kind of monitoring in some of the markets where it was marketed.

For this, they needed a partner who had experience in the pharmaceutical industry, as well as in the management of medicines under a monitoring regime, who could implement and be in charge of the outsourcing of the application management.

Challenges

After acquiring the marketing and distribution of Clozapine, Viatris needed to maintain the operation of the pharmacovigilance application for the proper attention of consumers, so it needed to find a partner who had experience in the pharmaceutical industry, as well as in the management of medications under a follow-up regimen.

Business Objective

Maintain compliance with global regulations of the pharmacovigilance program for a particular product marketed by the laboratory, as well as in improving the current technological platform that allows such management.

For this, the hiring of an application management outsourcing (AMO) service that contemplates the maintenance and support of levels 1, 2 and 3, aligned with ITIL methodology, was determined.

Results

Outsourcing of the complete management of the drug-surveillance program in the countries required by the client, aligned with demanding industry standards, and metrics that guarantee the established service level agreement must be permanently controlled.

Background

Viatris needed to put in place a pharmacovigilance program for a product that required this kind of monitoring in some of the markets where it was marketed.

For this, they needed a partner who had experience in the pharmaceutical industry, as well as in the management of medicines under a monitoring regime, who could implement and be in charge of the outsourcing of the application management.

Challenges

After acquiring the marketing and distribution of Clozapine, Viatris needed to maintain the operation of the pharmacovigilance application for the proper attention of consumers, so it needed to find a partner who had experience in the pharmaceutical industry, as well as in the management of medications under a follow-up regimen.

Business Objective

Maintain compliance with global regulations of the pharmacovigilance program for a particular product marketed by the laboratory, as well as in improving the current technological platform that allows such management.

For this, the hiring of an application management outsourcing (AMO) service that contemplates the maintenance and support of levels 1, 2 and 3, aligned with ITIL methodology, was determined.

Results

Outsourcing of the complete management of the drug-surveillance program in the countries required by the client, aligned with demanding industry standards, and metrics that guarantee the established service level agreement must be permanently controlled.

Would you like to join Huenei’s Tribe?

by Tomás Freyer | Jan 9, 2023

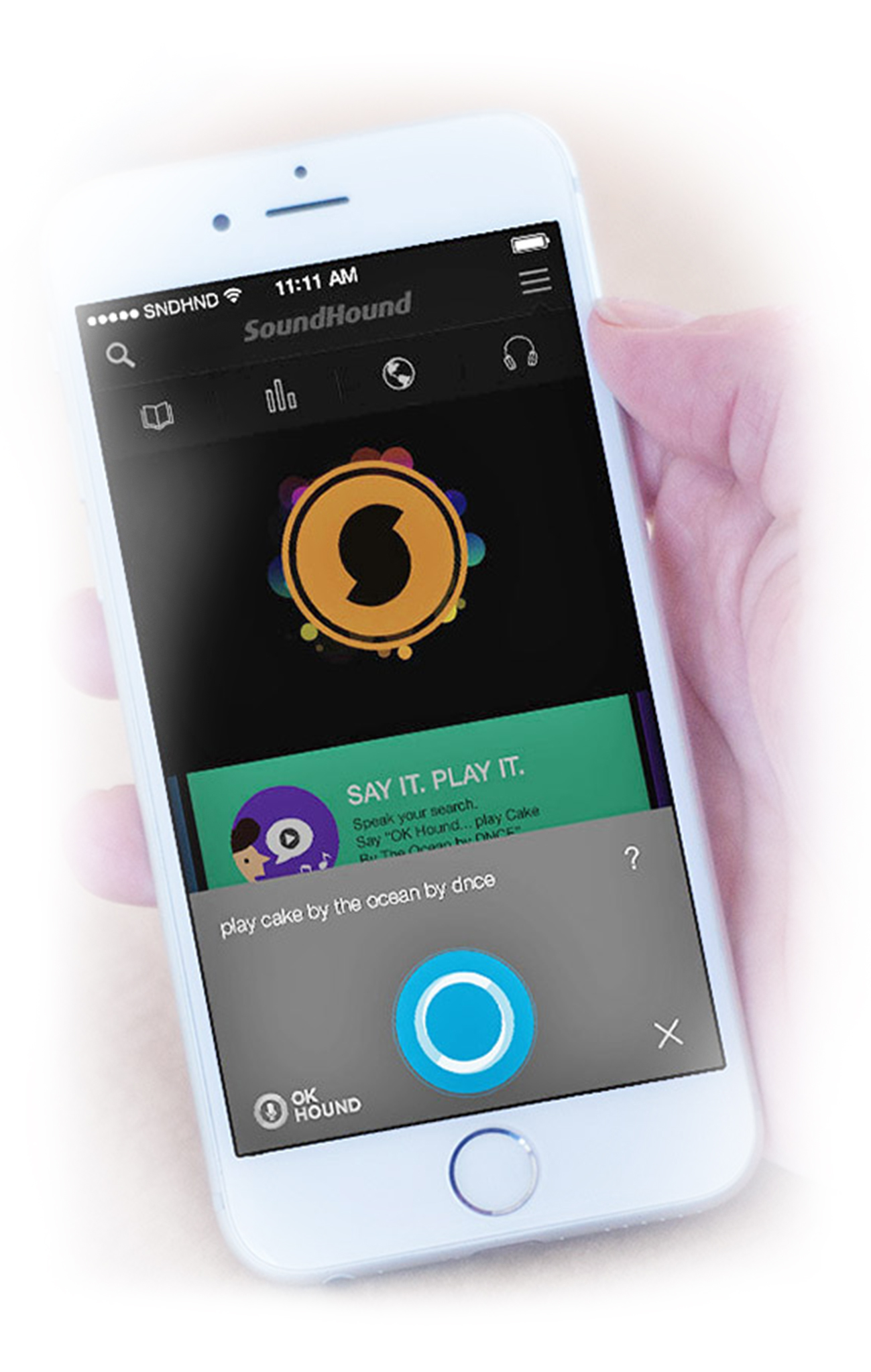

Voice Assistant Platform.

Development of a voice recognition product for the Spanish-speaking market.

Location: United States of America

Client: SoundHound

Industry: Information Technologies

Service: Dedicated Teams

Expertise: Software Development

Technologies: Java, Lua, C++, Python, PHP and GitLab

Solution

Development of the Spanish version of the main existing domains on the Houndify platform. For this, the queries that each domain can handle are analyzed, then these sentences are interpreted using the LUA programming language, translating them into all the commands available on the platform.

Subsequently, the platform generates a multiple response (visual, auditory and textual), whose texts are in English and translated into Spanish using the C ++ language. Additionally, libraries and tools are developed in Python, Bash and Perl languages.

Background

SoundHound is a company founded in 2005 that offers services related to voice and sound recognition for a variety of companies in different industries, from automotive to mass consumption.

Challenge

The client was looking for a reliable partner with whom to develop the Spanish version of all its voice and audio recognition service platforms. The partner had to adapt to SoundHound’s own platforms and developments, complying with the company’s high quality standards.

Business Objective

Develop the Spanish version of the main domains of the Houndify platform. Enter the Spanish-speaking markets at the right time and using the right resources. Offer this platform with the quality that clients demand in these markets.

Results

Integration of the Spanish version of domains to the Houndify platform so that it can perform the proper interpretation of text or voice queries from users, both for SoundHound and its clients. These queries must also produce an answer in Spanish.

Background

SoundHound is a company founded in 2005 that offers services related to voice and sound recognition for a variety of companies in different industries, from automotive to mass consumption.

Challenge

The client was looking for a reliable partner with whom to develop the Spanish version of all its voice and audio recognition service platforms. The partner had to adapt to SoundHound’s own platforms and developments, complying with the company’s high quality standards.

Business Objective

Develop the Spanish version of the main domains of the Houndify platform. Enter the Spanish-speaking markets at the right time and using the right resources. Offer this platform with the quality that clients demand in these markets.

Results

Integration of the Spanish version of domains to the Houndify platform so that it can perform the proper interpretation of text or voice queries from users, both for SoundHound and its clients. These queries must also produce an answer in Spanish.

Would you like to join Huenei’s Tribe?